Amazon’s eCommerce data, gathered from 400 million global consumers every month, makes Amazon’s Demand-Side Platform (DSP) the eCommerce data leader. With more customers joining every day, Amazon DSP’s benefits will only grow.

What is the Amazon DSP?

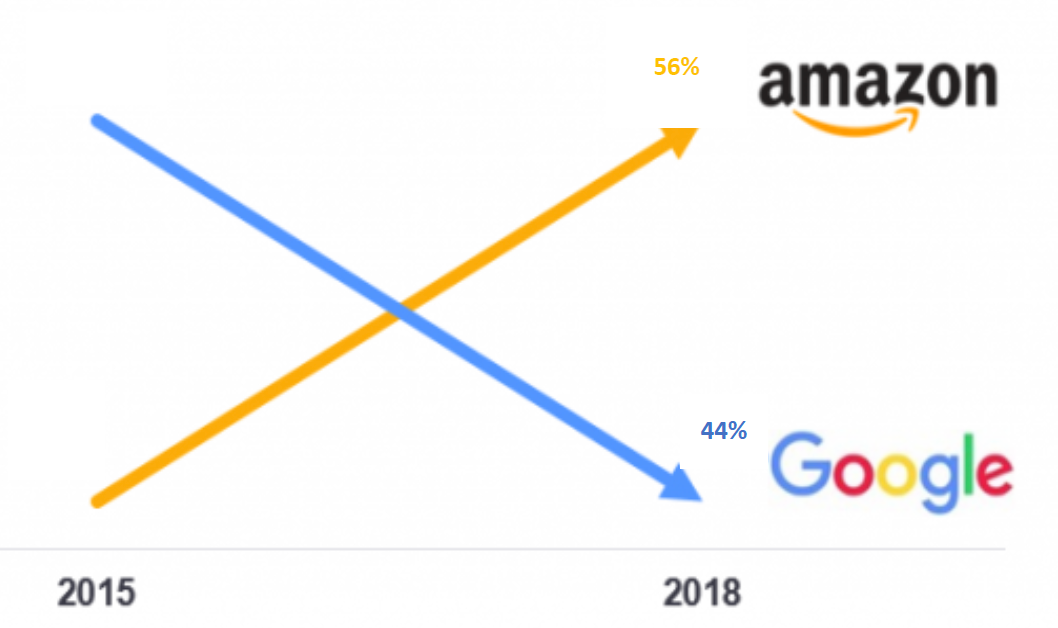

The Amazon Demand-Side Platform lets businesses buy display and video ads on and off Amazon. Its growth in popularity comes from the quality of Amazon’s eCommerce data. This difference in data quality is visible when comparing searches on Google and Amazon. The average share of product searches in the US, UK, Germany, and France soared to 56% on Amazon compared to just 44% on Google in 2018. This kind of information helps Amazon divert advertising revenue in their direction.

Average Share of Product Searches in the US, UK, DE, and FR

Source: MazeOne & eMarketer February 2019

To help you get an in-depth understanding of how to get started on Amazon, Vaimo has partnered with Maze-One to handle the intricacies of selling on Amazon and putting your Amazon strategy into practice. We also combined our expertise on Amazon and eCommerce into a free Amazon Readiness Assessment that you can take here.

In this article, we interview Michael Chabert, Partner and Co-founder at Maze-One. Michael has continuously monitored Amazon and has offered insights to various clients across industries to use Amazon for success in eCommerce.

In this interview, we cover a few essential topics:

- How does Amazon’s Demand-Side Platform purchasing data benefit retailers?

- How can retailers use Amazon?

- What explains the shift towards ad spending on Amazon DSP?

- What type of company should use Amazon DSP?

- What types of companies are working with you on an Amazon DSP strategy?

1. How does Amazon’s Demand-Side Platform purchasing data benefit retailers?

Even though your company matches Amazon, you might not want to sell on Amazon. For DSP, certain target groups can benefit. For example, if you’re a reseller and want traffic to your physical store or website. What do you do? This is where Amazon DSP comes in handy because DSP is just like Google Ads or Google Marketing. It is a significant competitor to Facebook Display Ads as they both help brands or resellers attract traffic to their channels. Amazon’s DSP does exactly this.

Arguably, Amazon outperforms Facebook and Google Ads/Google Marketing. On Google’s DSP, Google Marketing, you can buy search cookie pools. People searching for sports t-shirts on Google search see Google Ads. There are display ads everywhere, and Google uses that search history to display relevant personalised ads. Suppose they are on a website with Google ads and display advertising, you can then show ads based on their interests. It’s the same on Amazon, but they have much more rich and eCommerce-friendly data with more accurate shopping behaviour: people seeing, researching, and buying stuff.

On Amazon DSP, you find everybody searching for car parts for the past 30 days even when it involves rival companies. You can steal attention from your competitors even if you don’t want to sell on Amazon. With our clients, we use this rich consumer data and apply it to an Amazon tool so you can get those insights to target customers better and drive them to your channels.

Using Amazon DSP is one of the fastest-growing advertising tactics in Europe and the US right now. Amazon is taking market share from Google and Facebook. While Google has been the default leader of search data, Amazon is the leader on eCommerce search data. Amazon’s becoming an ever better data tool as it earns more loyalty from its customers and gathers their product search data.

2. How can retailers use Amazon?

If you’re a retailer, you can put goods on Amazon, or you can invest money driving traffic to your online and offline stores through Amazon DSP. Even though you can also spend that money on Google and Facebook, you will see money from retailers going in the direction of Amazon. The Amazon DSP is brilliant because it welcomes all businesses—not just those already selling on Amazon. This way, companies can still drive traffic to their website and offline store through leveraging Amazon’s buying data.

3. What explains the shift towards ad spending on Amazon DSP?

If shoppers search on Google, they see Adidas’ history and who invented Adidas. It’s not just about eCommerce on Google, but when you search for Adidas on Amazon, 99 percent of the situations are for one purpose: that’s buying. So their intentions are clear on Amazon search. That’s exactly the reason why this Amazon’s DSP platform is more efficient and why advertising money is moving towards Amazon from Google.

4. What type of company should use Amazon DSP?

Right now, if I have just 50 Euros, I will still be able to spend it on Facebook. It is the same with Google if I have 8 Euros I can spend on Google ads (self-service). DSP on Amazon is not for everybody; they have minimum budgets on DSP. It is for medium-sized and large companies. However, I expect that to change over time.

Amazon DSP is used both by companies who are selling on Amazon and want to build more traffic and sales on Amazon. In addition, Amazon DSP is used by companies who are not selling on Amazon but want to build traffic and sales on their own eCommerce platform. This group includes insurance companies and car manufacturers.

5. What types of companies are working with you on an Amazon strategy?

We have both large and small companies seeking services around Amazon. From a large company perspective, we work with Unilever, Philips, Siemens. Each one has different needs. Some edit and write the content themselves, and they want us to advertise. Now, Amazon’s arrival in Sweden forces them to think more about their content on Amazon. Big companies want us to go through Swedish content and get rid of automatic translations. They also want the consumer to have a great omnichannel experience with the brand, whether on the brand’s website, in their physical store, or on Amazon. We ensure that their Amazon content fits with their content on other channels.

We also have small brands with 3 to 5 people who operate in a niche market. One example is Spring Copenhagen, a Danish seller of premium home goods. Amazon is a niche strategy for them, and we helped them start from zero to achieve a high revenue in new markets.

Thanks again to Michael for this informative interview!

Do you want tailored feedback on your readiness to sell on Amazon? Click this link!

ABOUT MAZE-ONE

Maze-One is a full-service Amazon agency that is completely focused on marketplaces, which means that they can help with all facets of Amazon, bol.com, and other marketplaces. They believe that close cooperation with their customers is the basis for success.

Their fast-growing team consists of 35+ specialists and consultants with a vast expertise working with Amazon. They have offices in 5 markets and have already helped more than 100 large and smaller brands in ten markets with their platform objectives.

ABOUT VAIMO

Vaimo is a global expert in digital commerce. As an omnichannel agency, we deliver strategy, design, development and managed services to brands, retailers, and manufacturers.

We drive success in digital commerce with expertise in B2B, B2C, PIM, Order Management, and ERP integrations. With 12+ years of technical excellence, we support clients in business development, digital strategy and customer experience design.

With offices in 14+ markets across EMEA, APAC and North America and over 500 employees, we cultivate close relationships with our clients.

If you would like to learn more about how we can help you drive success in digital commerce, contact our team here.